At the end of Bill Guy’s tenure as Governor in 1973, during one of the most hotly contested US Senate races in North Dakota history, Republicans orchestrated an attack on the Bank. They demanded that the new Governor Art Link fire Bank President H.L. Thorndal. They pointed to allegations of kickback schemes, misappropriation of public funds, the loss of $22,000 to a con artist, and other signs of inadequate management. Although the Bank was making a profit and was generally well-managed, there was a kernel of truth in some of these allegations. In November 1972, Bill Guy lost his Senate race (to incumbent Milton R. Young) by merely 186 votes. Historians continue to debate whether the Bank “scandal” played a role in Bill Guy’s defeat.

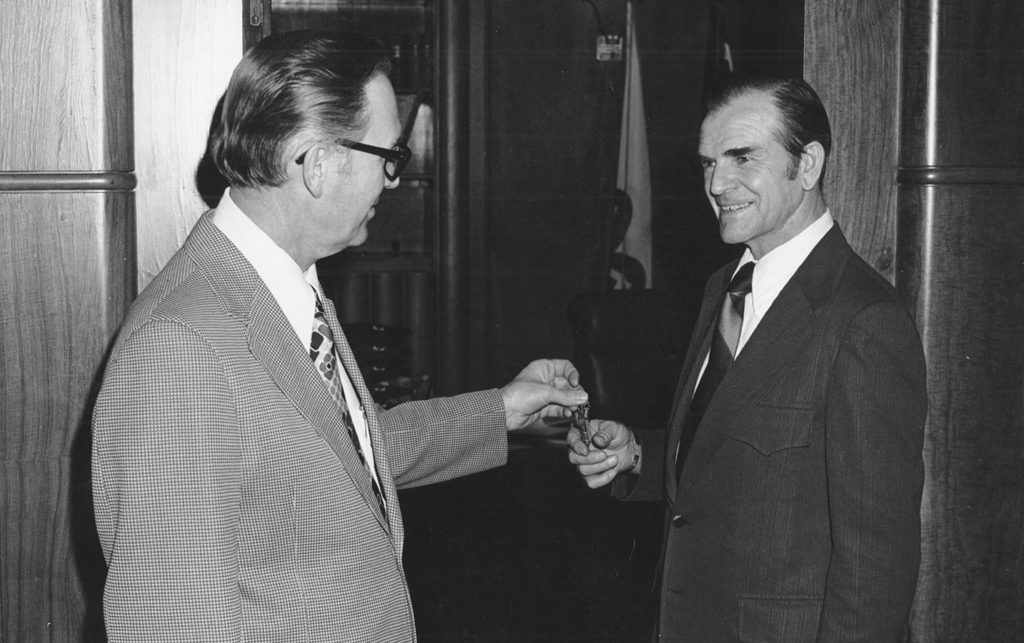

In 1975, the North Dakota Legislature created a committee to look into the Bank’s operations and management. It was the first investigation of the Bank since 1921, when political enemies of the Nonpartisan League used a legislative investigation to build a case to recall the Industrial Commission and close the Bank. In the monthlong 1975 investigation, 27 witnesses were called in 13 hearings. The result was a wide-ranging series of administration and policy changes at the Bank, all designed to protect the institution from embezzlement and political embarrassment. Lending procedures were tightened. Now individual Bank personnel were subject to limits on the value of loans they could authorize. Businesses with which the Bank had financial dealings were vetted for soundness and legitimacy. Access to the computer room was restricted.

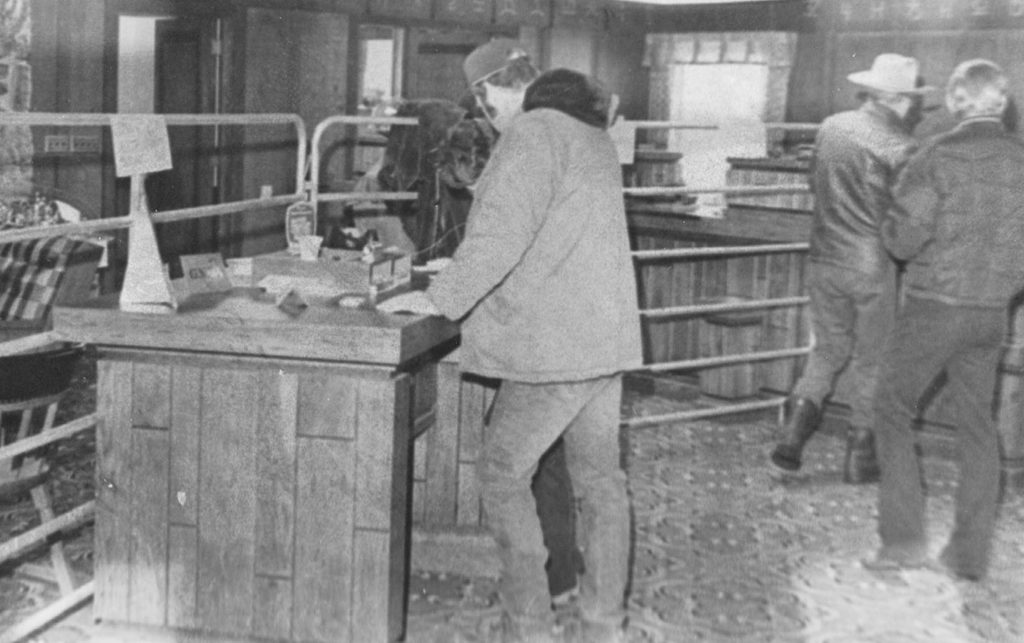

The Bank of North Dakota seized an opportunity to redeem itself in the eyes of residents when the Pioneer State Bank of Towner, ND, failed in 1975. BND stepped in boldly to limit the economic damage to the community. It opened a paying and receiving station in Towner, serviced 121 accounts, and handled $50,000 of transactions per day (on average) until the crisis abated. President Thorndal proudly declared, “The Bank of North Dakota’s involvement in the Towner Community added stability to the area in a time of need. It showed that the State of North Dakota cared and was concerned about the community’s crisis.” This incident served to remind the people of North Dakota why they had a state bank, that a state-owned bank could provide services that would be impossible or unthinkable among commercial lenders.